On March 23, scientists of the National University “Yuri Kondratyuk Poltava Polytechnic” – Doctor of Economic Sciences, Professor of the Department of Finance, Banking and Taxation Svitlana Onyshchenko, Candidate of Economic Sciences, Associate Professor of the Department of Finance, Banking and Taxation Alina Hlushko and Candidate of Economic Sciences, Associate Professor of the Department of Finance, Banking and Taxation Oleksandra Maslii took part in one of the key economic events of the year – UKRAINIAN TAX REFORM AND ANTI-CORRUPTION SUMMIT, held under the patronage of the Office of the President of Ukraine.

As President of Ukraine Volodymyr Zelenskyi emphasized in his speech in the Verkhovna Rada on December 28, the existing tax system does not suit either those who pay taxes or those who collect them. Ukrainian citizens who receive salaries and pensions from these taxes are not happy with it either. The head of state also noted that it is extremely important to reach national agreement on this issue.

The summit became a platform for establishing a dialogue between representatives of business and the state with the participation of international experts regarding the implementation of tax reform, which should ensure support for Ukrainian business in wartime, create prerequisites for bringing the economy out of the shadows and overcoming corruption in the tax system, reduce obstacles on the way to the European integration of Ukraine. Currently, the Office of the President, together with people’s deputies, is developing a tax reform project that will support Ukrainian business during wartime and create conditions for economic growth after victory. The discussion also concerned the successful global experience of tax reforms, best practices of income tax, key problems in the field of value added tax, anti-corruption fight in the licensing system.

Among the main speakers of the summit were representatives of the Office of the President of Ukraine, world-class economic and tax experts – Nobel laureate in economics Tom Sargent, Vice President of the World Bank for Europe and Central Asia Anna Bjerde, Director of Policy Affairs, Legatum Institute, United Kingdom Stephen Bryan, Executive Vice President, National Taxpayers Union Foundation Joseph Bishop-Henchman, Honorary President, Tax Foundation Scott Hodge, Lithuanian jurist and economist, ex-Minister of Justice of Lithuania Remigius Šimašius, Bulgarian Economist, ex-Minister of Finance of Bulgaria Simeon Djankov, Bulgarian economist, professor of Sofia University, founder of the Institute of Market Economy in Sofia Krassen Stanchev and others.

Greetings for the summit from the head of the Office of the President of Ukraine Andrii Yermak was read by the chief consultant of the head’s office of the Office of the President Oleh Havrysh.

“One of our key tasks is to rebuild the country after defeating the aggressor on the battlefield. The reconstruction process will require maximum consolidation of efforts... It is extremely important for us to attract both foreign and domestic investors to the construction of a new country. And for this, it is necessary to create the best conditions for doing business. And among them, the taxation model is one of the most important, so I am very glad that an extraordinary number of international experts have gathered here today, helping to carry out our reform.

Let’s set a goal – by our victory, to work out such a model that will make it possible to create the most attractive conditions for doing business among competitor countries. It is not enough to offer tax conditions no worse than those of neighbours – they should be much better. In the global competition for investments, Ukraine should become a champion. At the same time, our reform should once and for all eliminate corruption from the tax sphere.

I call for the creation of such a tax reform option that will make the prosperity of Ukraine inevitable, it deserves it. Glory to Ukraine!” – said the address of the head of the Office of the President of Ukraine.

Deputy Head of the Office of the President Rostyslav Shurma, in his speech at the summit, noted that the state should take into account the fact that private sector enterprises will play a leading role in post-war reconstruction and economic recovery. And that is why it is necessary to create favourable conditions for business development as well as to form reliable prospects for capital investments, in order to prevent the outflow of entrepreneurs abroad.

“The system that we will propose for the post-war reconstruction of Ukraine should not lose to our competitors, such as Poland, Bulgaria, and Hungary. Of course, if the income tax here is 18%, and in Bulgaria – 10%, in Hungary – 9%, then certain questions arise. We need a fundamental reset, which will provide competitive conditions and eliminate the motivation for corruption,” – noted Rostyslav Shurma.

The Vice President of the World Bank for Europe and Central Asia Anna Bjerde said at the summit that the management of the institution supports Ukraine in its efforts to implement anti-corruption tax reform despite the crisis caused by the war.

“The World Bank welcomes this summit, since both tax reform and anti-corruption initiatives are two incredibly important elements that Ukraine must deal with while simultaneously fighting russia’s military invasion and solving the task of keeping the economy afloat,” – emphasized Anna Bjerde.

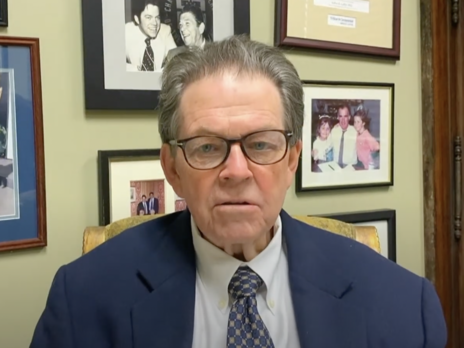

American expert in economics, one of the authors of the theory of supply, Arthur Laffer, in his message to the participants of the event, stated that the main means of achieving success during the implementation of economic reform in Ukraine is to reduce the tax rate while simultaneously expanding the tax base. According to the scientist, other indicators that the Ukrainian government should focus on when forming the direction of economic reform are trade, privatization and moderate delegation of decision-making powers to interdepartmental committees.

He also wished the Ukrainian specialists – the authors of the economic reform – strength and success, as they face a huge task: now Ukraine needs a stable and efficient financial system more than any other country in the world.

During the panel discussions, the summit participants focused on such key issues as reducing tax rates for detinization of business, improving tax administration, simplifying the permit system, ensuring the rule of law and implementing effective anti-corruption measures.

Recently, the IX International Industry Forum was held at the Poltava Polytechnic, dedicated to energy security as the main priority direction for the development of the oil and gas industry of Ukraine.

Media Center of

National University “Yuri Kondratyuk Poltava Polytechnic”