The academic staff of Finance, Banking and Taxation Department of National University "Yuri Kondratyuk Poltava Polytechnic” held a meeting of a student scientific club during which the students of the specialization “Finance, Banking and Taxation” discussed the ways and the possible risks of P2P lending, artificial intelligence and biometrics in the financial field, and the prospects of introducing the electronic hryvnia.

The participants of the scientific club headed by Doctor of Economics, Professor of Finance, Banking and Taxation Department Svitlana Yehorycheva presented scientific reports and discussed cases of financial market development. The following speakers shared their thoughts on the financial business:

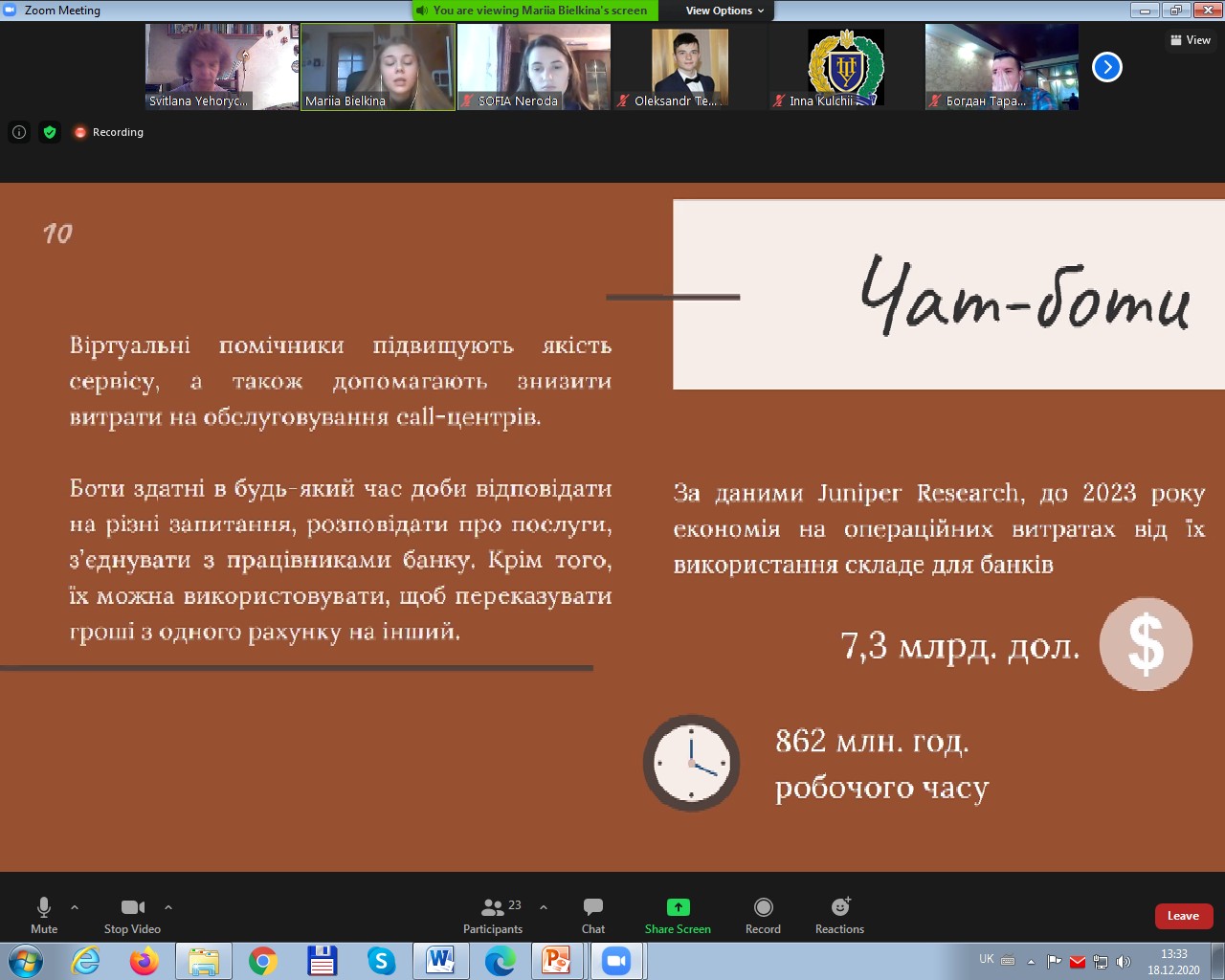

- Mariia Bielkina, holder of the scholarship of the Verkhovna Rada, student of group 301EF of Education and Research Institute of Finance, Economics and Management (“Artificial intelligence and biometrics in finance”);

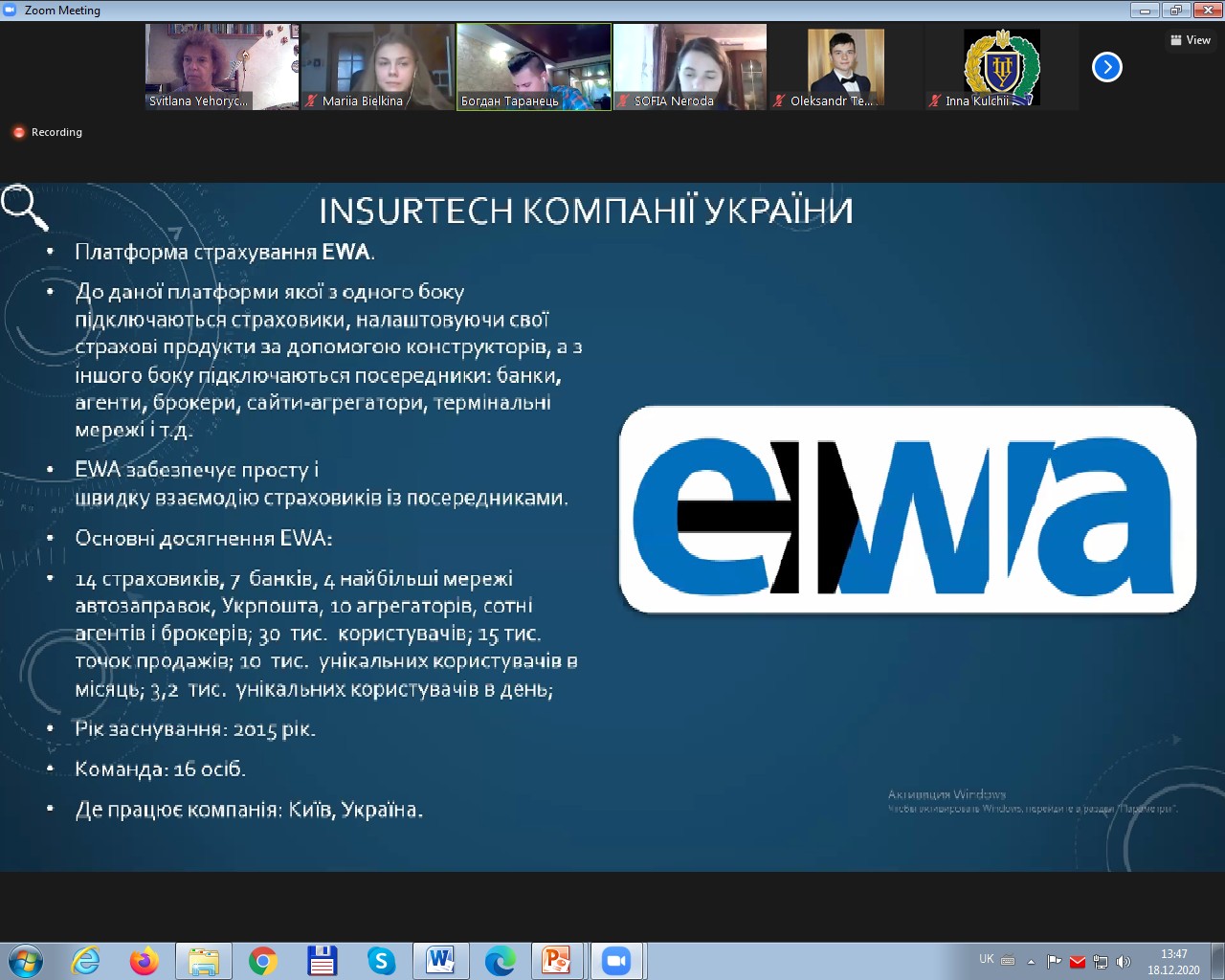

- Bohdan Taranets, student of group 301EF of Education and Research Institute of Finance, Economics and Management (“Development of InsureTech in Ukraine”);

- Vladyslava Koshova and Alina Shtepenko, students of group 201-EFpr of Education and Research Institute of Finance, Economics and Management (“FinTech for payments in Ukraine”);

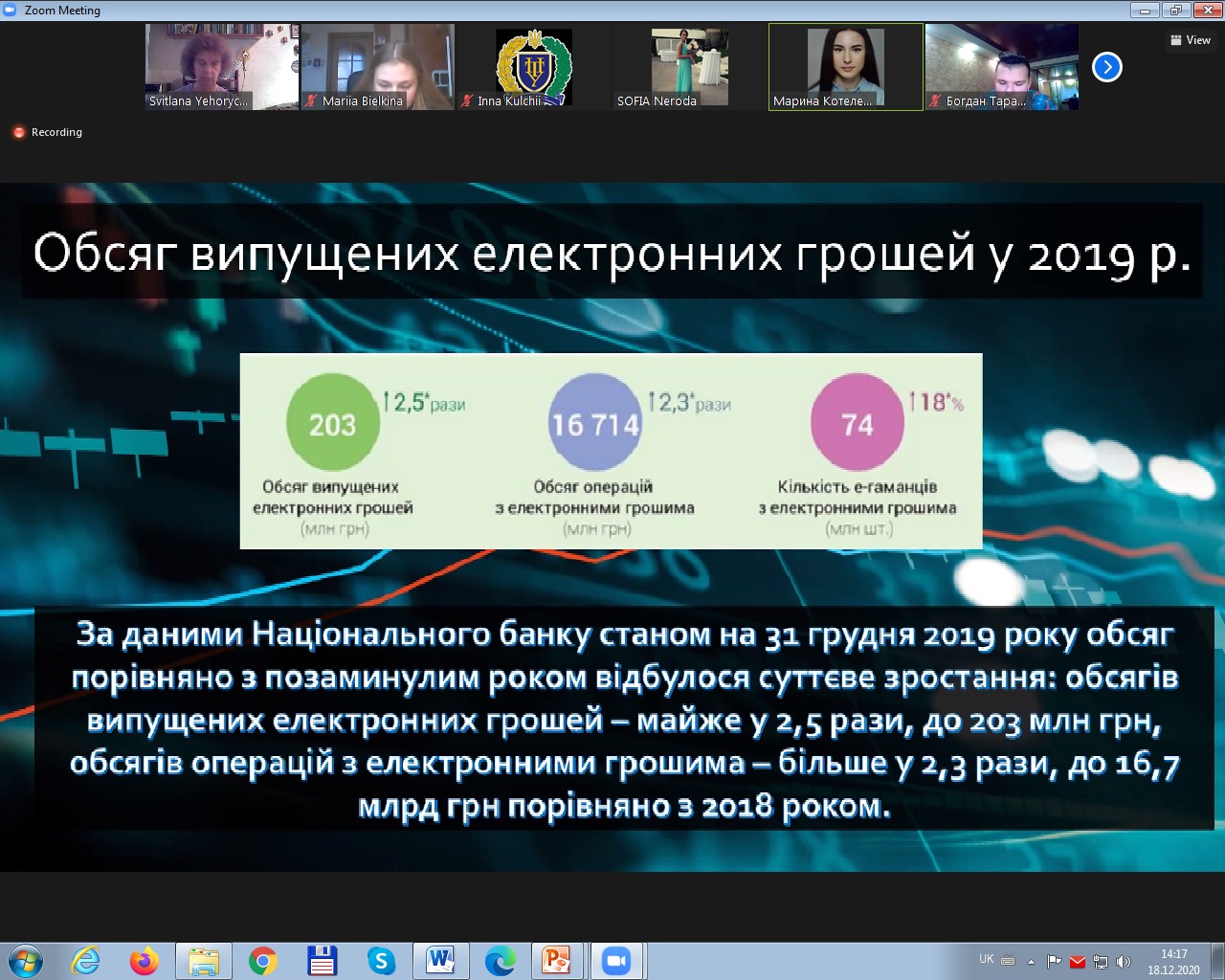

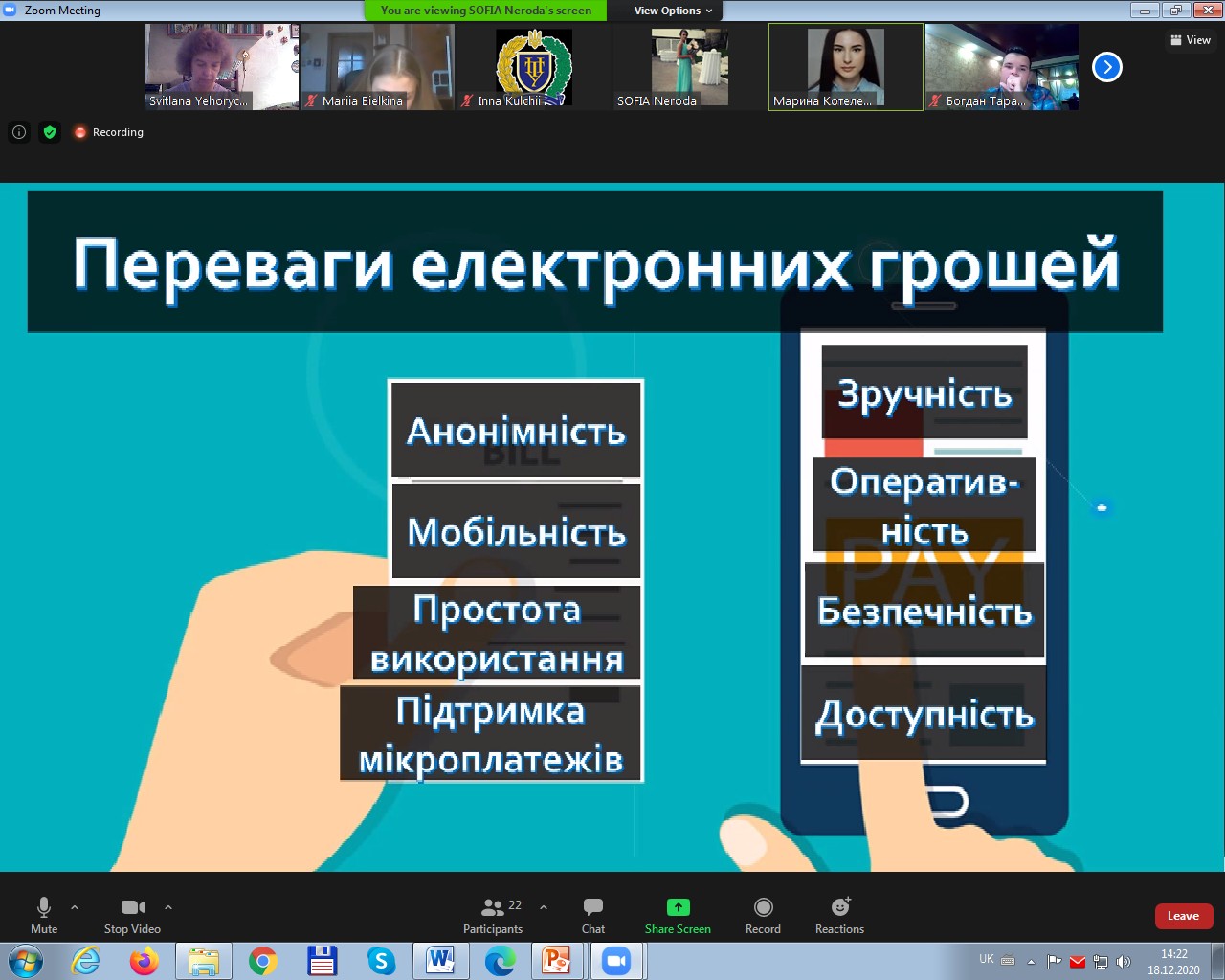

- Maryna Kotelevets and Sofiia Neroda, students of group 501FB of Education and Research Institute of Finance, Economics and Management (“Causes and prospects of introducing electronic hryvnia”);

- Oleksandr Terpak, student of group 101BB of Education and Research Institute of Finance, Economics and Management (“P2P-lending and possible risks for users”).

The speakers listed the advantages and additional possibilities for users of innovative lending companies and mentioned certain risks that should be taken into account. General problems include the lack of the regulations necessary for FinTech sector, which causes difficulties in defending the consumers’ rights in the field of innovative financing. However, solving these issues is one of the goals of the Strategy of FinTech Development, presented by the National Bank of Ukraine to be implemented until 2025.

By the way, finance scientists analyzed the globalization challenges and the influence of the pandemic on the financial stability of Ukraine at the II International Conference “Development of the Financial Market in Ukraine: Risks, Problems and Prospects”, dedicated to the 90th anniversary of National University "Yuri Kondratyuk Poltava Polytechnic".

The participants of the meeting came to a conclusion that the financial future of our country lies in building and innovative financial market with large-scale financial inclusion (of citizens and business) and convenient and safe consumer services and products, available for everyone in pricing and distribution.

The previous meeting of the scientific club was dedicated to the World Savings Day, and during the discussion, the students learned how to effectively plan their spendings and savings.

The academic staff of Finance, Banking and Taxation Department of National University "Yuri Kondratyuk Poltava Polytechnic” held a meeting of a student scientific club during which the students of the specialization “Finance, Banking and Taxation” discussed the ways and the possible risks of P2P lending, artificial intelligence and biometrics in the financial field, and the prospects of introducing the electronic hryvnia.

The participants of the scientific club headed by Doctor of Economics, Professor of Finance, Banking and Taxation Department Svitlana Yehorycheva presented scientific reports and discussed cases of financial market development. The following speakers shared their thoughts on the financial business:

- Mariia Bielkina, holder of the scholarship of the Verkhovna Rada, student of group 301EF of Education and Research Institute of Finance, Economics and Management (“Artificial intelligence and biometrics in finance”);

- Bohdan Taranets, student of group 301EF of Education and Research Institute of Finance, Economics and Management (“Development of InsureTech in Ukraine”);

- Vladyslava Koshova and Alina Shtepenko, students of group 201-EFpr of Education and Research Institute of Finance, Economics and Management (“FinTech for payments in Ukraine”);

- Maryna Kotelevets and Sofiia Neroda, students of group 501FB of Education and Research Institute of Finance, Economics and Management (“Causes and prospects of introducing electronic hryvnia”);

- Oleksandr Terpak, student of group 101BB of Education and Research Institute of Finance, Economics and Management (“P2P-lending and possible risks for users”).

The speakers listed the advantages and additional possibilities for users of innovative lending companies and mentioned certain risks that should be taken into account. General problems include the lack of the regulations necessary for FinTech sector, which causes difficulties in defending the consumers’ rights in the field of innovative financing. However, solving these issues is one of the goals of the Strategy of FinTech Development, presented by the National Bank of Ukraine to be implemented until 2025.

By the way, finance scientists analyzed the globalization challenges and the influence of the pandemic on the financial stability of Ukraine at the II International Conference “Development of the Financial Market in Ukraine: Risks, Problems and Prospects”, dedicated to the 90th anniversary of National University "Yuri Kondratyuk Poltava Polytechnic".

The participants of the meeting came to a conclusion that the financial future of our country lies in building and innovative financial market with large-scale financial inclusion (of citizens and business) and convenient and safe consumer services and products, available for everyone in pricing and distribution.

The previous meeting of the scientific club was dedicated to the World Savings Day, and during the discussion, the students learned how to effectively plan their spendings and savings.

Media Center of

National University “Yuri Kondratyuk Poltava Polytechnic”